BlackRock to Buy Panama Canal Ports in $22.8 Billion Deal

Globalist money manager to control vital global trade chokepoint.

In a major advancement of globalism’s grip on the world, BlackRock has just pulled off one of its most geopolitically significant infrastructure deals to date, securing control over the ports at both ends of the Panama Canal in a staggering $23 billion acquisition.

Follow Jon Fleetwood: Instagram @realjonfleetwood / Twitter @JonMFleetwood / Facebook @realjonfleetwood

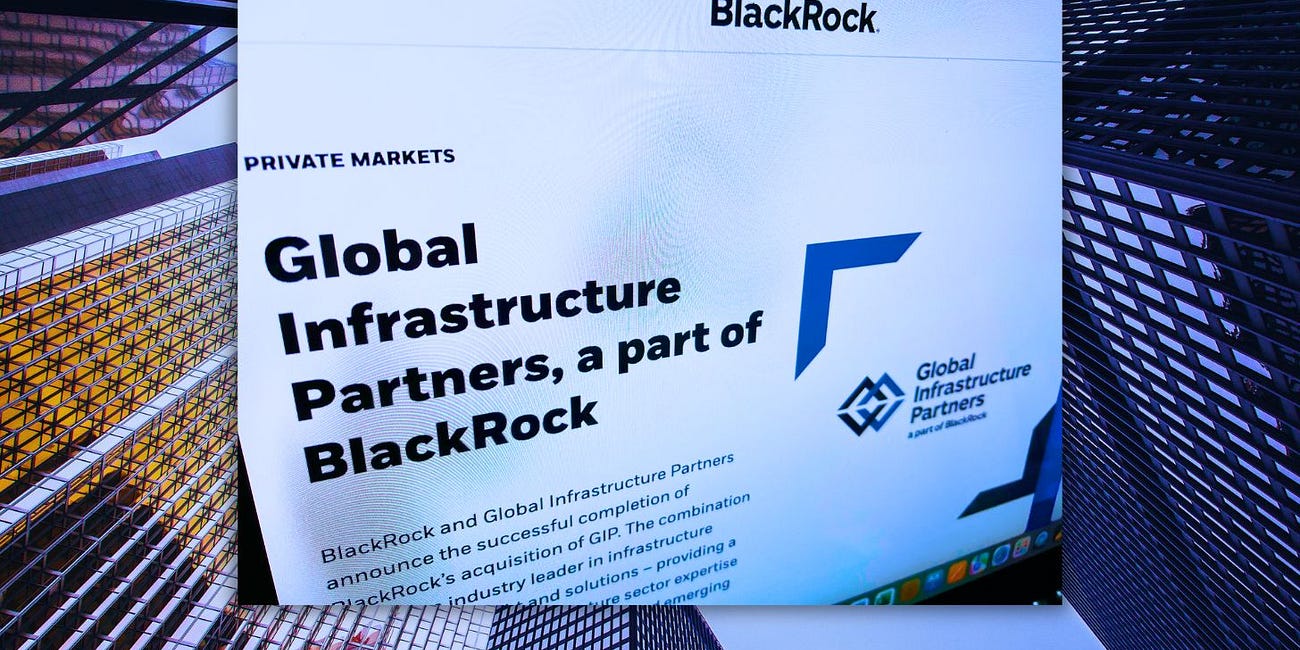

While its $170 billion takeover of Global Infrastructure Partners (GIP) was its largest deal by dollar value, this move consolidates unprecedented power over one of the world’s most strategic waterways.

BlackRock is a key partner of the World Economic Forum (WEF), an organization known for advancing a global agenda that includes controversial initiatives like climate change, Diversity, Equity, and Inclusion (DEI) efforts, and population management.

The WEF’s official partners, including BlackRock, are described as the “driving force” behind the Forum’s programs, which are aligned with the broader concept of the Great Reset—an effort to reshape global economies and governments according to the desires of an unelected global elite.

Many view BlackRock as the vehicle through which globalist elites have consolidated control over the corporate world on a global scale.

By securing control over both ends of the Panama Canal, BlackRock has positioned itself as a gatekeeper of global trade, further entrenching its influence over the world’s most critical supply routes.

What Just Happened?

A consortium led by BlackRock, including its subsidiary Global Infrastructure Partners and Terminal Investment Limited, reached an agreement to acquire 43 ports across 23 countries from Hong Kong-based CK Hutchison Holdings.

The crown jewels of the deal? The Balboa and Cristobal ports—key transit points on either side of the Panama Canal. These ports are the lifeblood of global shipping, handling a massive volume of U.S.-bound cargo.

The Money and Power at Stake

The Panama Canal is responsible for 4% of all maritime trade and facilitates over 70% of the sea traffic heading to or from U.S. ports. It generates billions in revenue annually, and those numbers will only grow as global trade becomes more centralized. Owning these ports isn’t just about profits—it’s about controlling the flow of global commerce, determining who gets access and at what cost.

BlackRock, the world’s largest asset manager, already oversees more than $11 trillion in assets—a sum greater than the GDP of every nation on Earth except for the U.S. and China. This acquisition cements its dominance over international trade, giving it an iron grip on one of the world’s most critical shipping lanes.

Why It Matters

This deal didn’t happen in a vacuum. The Trump administration had been hammering on Chinese involvement in the Panama Canal for years. In January, Senator Ted Cruz warned that China could manipulate passage through the canal, calling the situation an “acute risk to U.S. national security.” Then came Secretary of State Marco Rubio’s February visit to Panama, where he told Panamanian officials to cut ties with China or face U.S. retaliation. Days later, Panama pulled out of China’s Belt and Road Initiative, and suddenly, CK Hutchison—long under scrutiny for its Chinese ties—was looking for a buyer.

Enter BlackRock. While President Trump’s rhetoric had centered around “taking back the Panama Canal,” what happened instead is that America’s most powerful private investment firm now owns the ports on either end of the canal. The U.S. didn’t retake the canal—the globalist financial elite did.

Strategic Implications

This is more than just an investment—it’s a geopolitical power shift.

Global Trade Control: BlackRock and its partners now determine who gets to use these ports, how much they pay, and whether they get priority access.

National Security: With over three-quarters of vessels passing through the canal originating in or heading to the U.S., control over these ports means control over America’s supply chains.

Geopolitical Leverage: This move effectively neutralizes Chinese influence over the canal, replacing it with the influence of the world’s most powerful financial entity.

Regulatory Capture: BlackRock has spent years embedding itself into U.S. government policy circles. Its control of these ports means a convergence of public and private power unlike anything seen before.

The Bigger Picture

While BlackRock’s $170 billion acquisition of Global Infrastructure Partners was its largest deal by monetary value, this Panama Canal acquisition may be its most consequential in terms of global influence. The GIP deal gave BlackRock control over energy, transportation, and water infrastructure worldwide—but now, with ownership of the ports at one of the most strategic trade routes on the planet, its influence over international commerce reaches an entirely new level.

And yet, while headlines may focus on Trump’s “win” in removing Chinese influence from the Panama Canal, the reality is that America’s most influential financial institution—not the U.S. government—now holds the keys to this critical global artery.

BlackRock’s Growing Ties to Trump’s World?

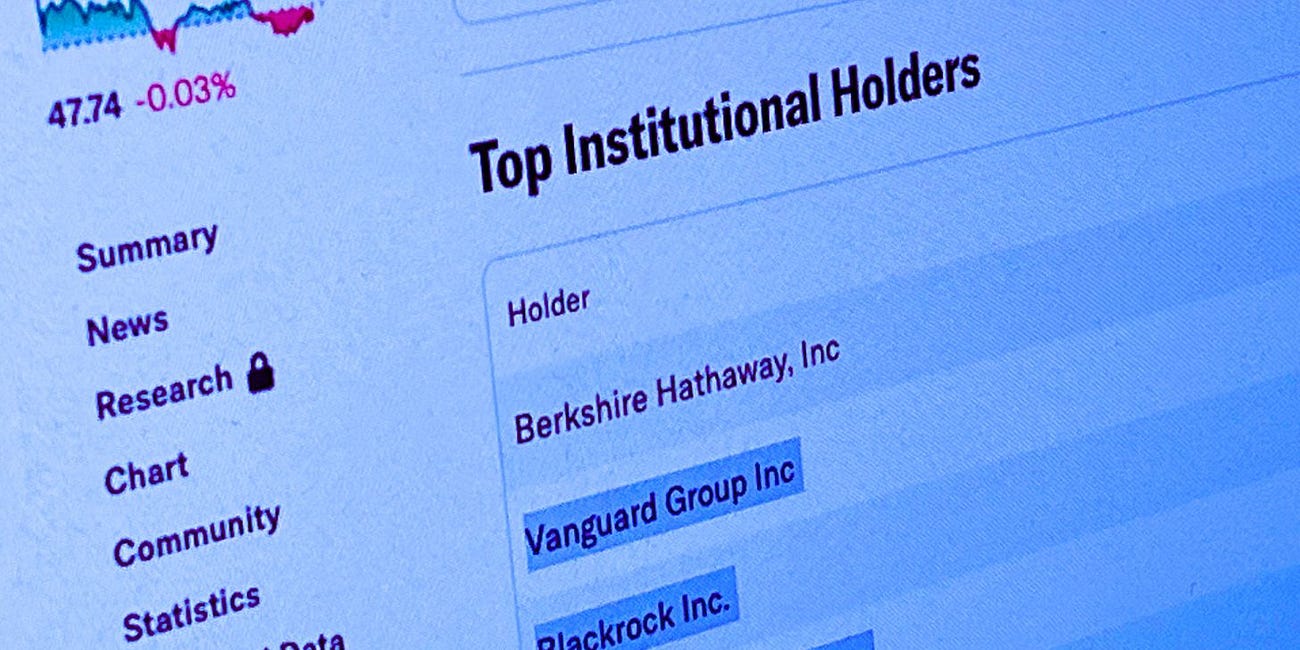

While Trump has publicly criticized BlackRock’s influence, financial filings reveal that BlackRock and Vanguard collectively hold $350 million in shares in Trump Media & Technology Group. This raises questions about whether BlackRock’s increasing financial entanglements with Trump-connected entities, including this Panama Canal deal, signal deeper alignment—or merely opportunistic investments. Historically, these firms have used their ownership stakes in major corporations to push ESG compliance and other globalist political initiatives. If BlackRock’s influence in Trump’s orbit continues to grow, it could reshape the balance of power between financial elites and the administration itself.

This raises fundamental questions: Who really controls trade? Who controls geopolitics? And who actually governs the United States?

BlackRock’s move on the Panama Canal isn’t just a power play—it’s a preview of what’s to come.

Follow Jon Fleetwood: Instagram @realjonfleetwood / Twitter @JonMFleetwood / Facebook @realjonfleetwood

BlackRock, Vanguard Hold 13 Million Shares in Trump Media Corp Valued at $350 Million

BlackRock and Vanguard—two of the world’s largest asset managers, both affiliated with the World Economic Forum (WEF)—are among the top institutional shareholders of Trump Media & Technology Group Corp. (DJT), the publicly traded company behind Truth Social, according to newly released financial filings.

Texas AG Paxton, 10 Other States Sue BlackRock, State Street, Vanguard for 'Illegally Conspiring to Manipulate Energy Markets, Driving Up Costs for Consumers'

Attorney General Ken Paxton has sued BlackRock, State Street Corporation, and Vanguard Group for “conspiring to artificially constrict the market for coal through anticompetitive trade practices.”

BlackRock's $170 Billion Infrastructure Takeover: How the World's Largest Asset Manager Now Controls Critical Global Resources

BlackRock Inc., the world’s largest asset manager, has completed its $170 billion acquisition of Global Infrastructure Partners (GIP), giving it control over new essential infrastructure in more than 100 countries.

BlackRock’s Assets Reach $11.5 Trillion—Now Nearly 11% of Global GDP, Raising Concerns Over Expansive Influence

BlackRock Inc., the world’s largest asset manager, has seen its assets under management (AUM) swell to a staggering $11.5 trillion, a sum that now represents almost 11% of the global GDP.

BlackRock Joins $6 Billion Funding for Musk's xAI, Sparking Concern Over Globalist Influence in AI's Future

BlackRock Inc. has participated in a landmark $6 billion Series C financing round for Elon Musk’s AI venture, xAI, cementing the asset manager’s growing influence and strategic leverage over the company’s future direction.

A nice definition of what is 'fascism': "Its control of these ports means a convergence of public and private power unlike anything seen before."

Globalist continue to take over. 🇺🇸US Military should control the Panama Canal, Toll Charges to use this Canal should be paid to the US government in Cryptocurrency and that income should be added to Americas Strategy Reserves💰