BlackRock Joins $6 Billion Funding for Musk's xAI, Sparking Concern Over Globalist Influence in AI's Future

World Economic Forum partner gains strategic leverage over Elon Musk's AI venture.

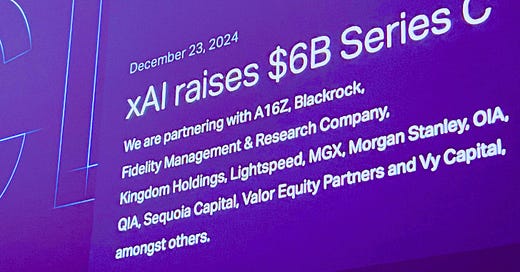

BlackRock Inc. has participated in a landmark $6 billion Series C financing round for Elon Musk’s AI venture, xAI, cementing the asset manager’s growing influence and strategic leverage over the company’s future direction.

Follow Jon Fleetwood: Instagram @realjonfleetwood / Twitter @JonMFleetwood / Facebook @realjonfleetwood

Musk’s growing dominance in the tech sphere, now spanning social media and artificial intelligence, raises concerns among critics wary of BlackRock’s deep ties to China and its promotion of agendas centered on DEI (diversity, equity, and inclusion), globalism, and climate change.

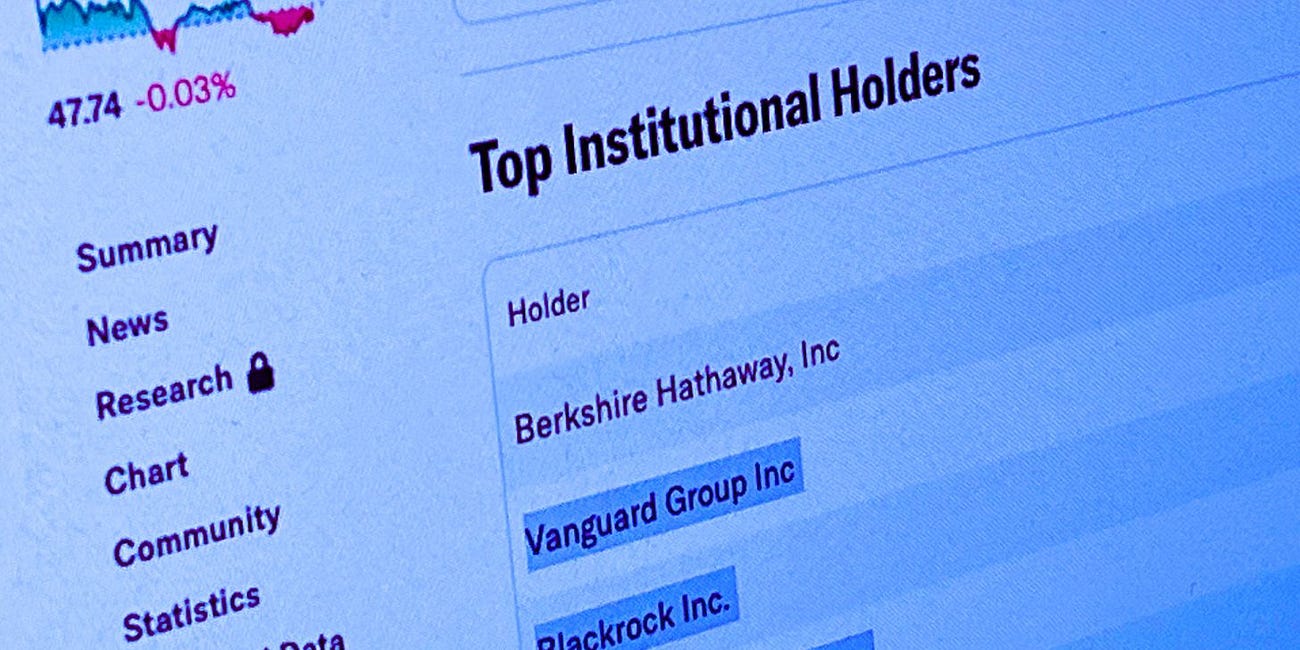

Musk’s Tesla—also owned by BlackRock—already bolsters China’s interests, as the majority of batteries for Tesla vehicles are supplied by Contemporary Amperex Technology (CATL), a leading Chinese lithium-ion battery manufacturer.

Moreover, BlackRock, a money manager with $11.5 trillion in assets under management (AUM), is an official partner of the World Economic Forum (WEF).

The WEF’s ‘Partners’ page explains that the companies it allies with “are the driving force behind the Forum’s programmes,” including the Forum’s Great Reset initiative.

According to the WEF, a future is coming in which global citizens will “own nothing” and “be happy” about it, and the United States will no longer be the world’s leading superpower.

BlackRock’s allegiance to the WEF’s agenda is significant because the asset manager owns controlling shares of thousands of companies across multiple industries, including many of those on the Fortune 500 and Fortune 100 lists.

Questions arise as to whether BlackRock’s increasing influence over Musk’s ventures, combined with its alignment with the WEF’s anti-national sovereignty Great Reset agenda, could steer these technologies toward serving globalist interests rather than preserving innovation, freedom, and national sovereignty.

BlackRock has been sued by Texas and 10 other states for conspiracy over its “illegal weaponization of the financial industry,” according to Texas Attorney General Ken Paxton.

xAI’s Announcement

Musk’s xAI announced last week that Blackrock, along with Andreessen Horowitz, Kingdom Holdings, Lightspeed, MGX, Morgan Stanley, OIA, QIA, Sequoia Capital, Valor Equity Partners and Vy Capital, and others, had participated in the funding round.

These contributions have already led to “significant technical progress” in the AI company’s following initiatives, according to the announcement:

“Colossus, xAI has established a decisive hardware advantage with the world's largest AI supercomputer using an NVIDIA full stack reference design with 100,000 NVIDIA Hopper GPUs. Compared to typical multi-year industry timeframes, Colossus was fully operational in 122 days and started running workloads just 19 days after the first servers were delivered. Soon, xAI will double the size of Colossus to a combined total of 200,000 NVIDIA Hopper GPUs, achieved by using the NVIDIA Spectrum-X Ethernet networking platform.”

“xAI API, gives developers programmatic access to our foundation models and is built on a new bespoke tech stack that allows multi-region inference deployments for low-latency access across the world.”

“Aurora, xAI’s proprietary autoregressive image generation model for Grok enhances multimodal understanding, editing, and generation capabilities”

Notably, the funding has gone to enhancing Grok, an AI chatbot developed by Musk’s xAI.

The announcement highlighted the development of Grok 2, xAI’s frontier language model boasting state-of-the-art reasoning capabilities.

Additionally, Grok integrates with 𝕏, leveraging the platform to deliver real-time insights into global events, complete with enhanced features such as web search, citations, and the newly unveiled image generation tool, Aurora.

Who Is Shaping the Future of AI?

Asset managers like BlackRock, by virtue of owning shares of a company, own that company and can direct their policies and political stances with the power of the purse and boardroom votes.

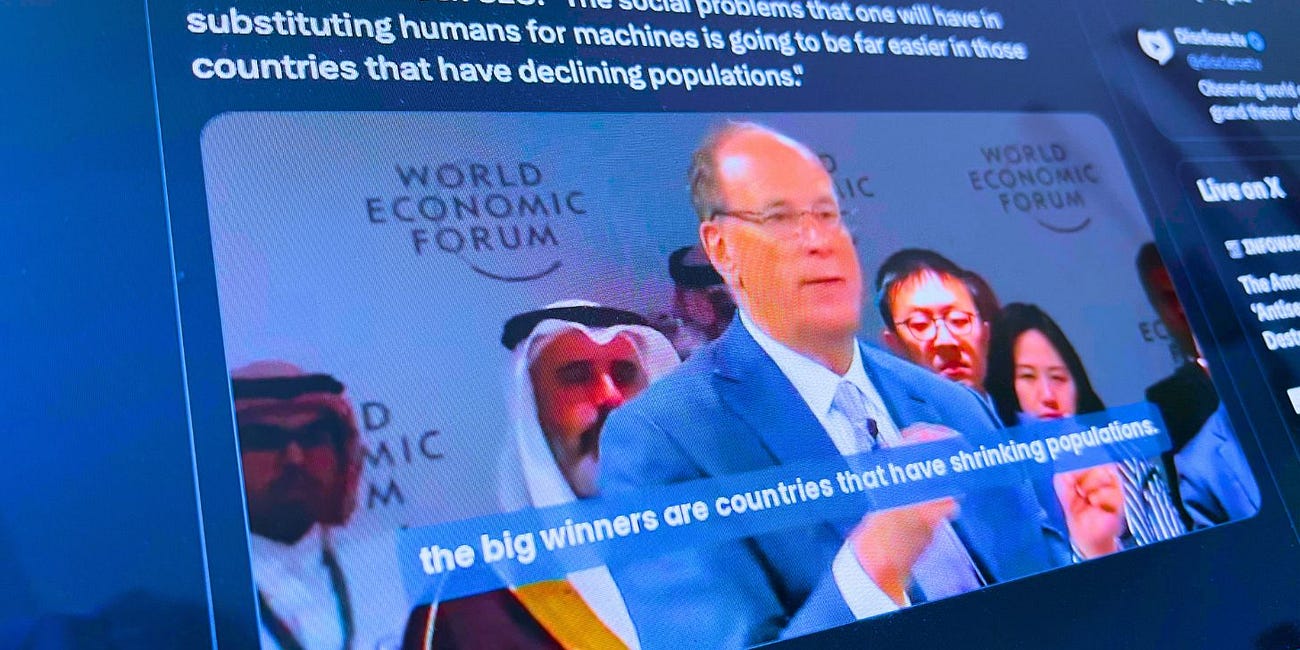

BlackRock CEO Larry Fink has confirmed this, admitting that he is “forcing behaviors” on the companies his money manager owns, which span every major industry and sector.

“Behaviors are gonna have to change and this is one thing we’re asking companies. You have to force behaviors, and at BlackRock, we are forcing behaviors,” Fink said during a 2017 New York Times interview.

With BlackRock’s financial muscle and the WEF’s globalist agenda now intertwined with Musk’s rapidly expanding AI empire, the question isn’t just about technological progress—it’s about control.

Who will truly shape the future of AI: independent innovators or powerful entities driven by opaque agendas that risk undermining national sovereignty and individual freedoms?

Follow Jon Fleetwood: Instagram @realjonfleetwood / Twitter @JonMFleetwood / Facebook @realjonfleetwood

The WEF 'Axis of Evil': How The World Economic Forum Controls Everything You Do

The World Economic Forum (WEF) is behind the global climate change narrative, promoting China as the next world superpower, and worldwide Diversity, Equity, and Inclusion (DEI) efforts.

Texas AG Paxton, 10 Other States Sue BlackRock, State Street, Vanguard for 'Illegally Conspiring to Manipulate Energy Markets, Driving Up Costs for Consumers'

Attorney General Ken Paxton has sued BlackRock, State Street Corporation, and Vanguard Group for “conspiring to artificially constrict the market for coal through anticompetitive trade practices.”

BlackRock’s Assets Reach $11.5 Trillion—Now Nearly 11% of Global GDP, Raising Concerns Over Expansive Influence

BlackRock Inc., the world’s largest asset manager, has seen its assets under management (AUM) swell to a staggering $11.5 trillion, a sum that now represents almost 11% of the global GDP.

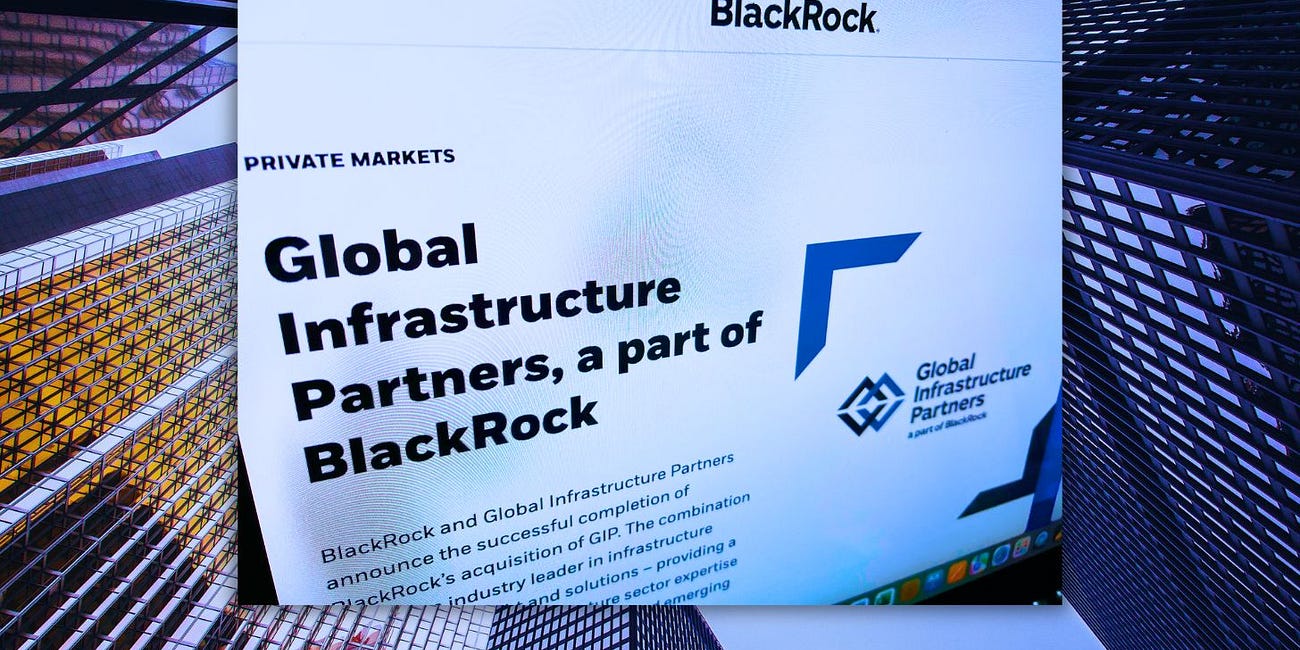

BlackRock's $170 Billion Infrastructure Takeover: How the World's Largest Asset Manager Now Controls Critical Global Resources

BlackRock Inc., the world’s largest asset manager, has completed its $170 billion acquisition of Global Infrastructure Partners (GIP), giving it control over new essential infrastructure in more than 100 countries.

Depopulation Agenda Endorsed by WEF-Allied BlackRock CEO Larry Fink: 'Shrinking Populations' Better for 'Robotics and AI' Takeover (Video)

BlackRock Inc. CEO Larry Fink praised depopulation, an idea associated with reducing the number of people in a country or region, in remarks made during the World Economic Forum’s (WEF) recently held ‘Special Meeting on Global Collaboration, Growth and Energy Development’ in Saudi Arabia.

List of Every Company Officially Partnered With the World Economic Forum (WEF)

The 54th Annual Meeting of The World Economic Forum (WEF) is currently underway at Davos-Klosters in the Swiss canton of Graubünden.

So pleased I took initiative to abandon these ill intended, life sucking, monsters - You all should too!

BDS Blackrock, Fisher Investments, Amazon and other groups corporate sponsoring the WEF.