BlackRock's $170 Billion Infrastructure Takeover: How the World's Largest Asset Manager Now Controls Critical Global Resources

World Economic Forum ally aims for "generational" influence.

BlackRock Inc., the world’s largest asset manager, has completed its $170 billion acquisition of Global Infrastructure Partners (GIP), giving it control over new essential infrastructure in more than 100 countries.

Follow Jon Fleetwood: Instagram @realjonfleetwood / Twitter @JonMFleetwood / Facebook @realjonfleetwood

This consolidation means BlackRock now wields influence over industries crucial to the global economy, including energy, transportation, water, and waste management.

The magnitude of this acquisition gives BlackRock unprecedented leverage in reshaping critical infrastructure sectors worldwide.

In their official press release, BlackRock stated, “The combination creates an industry leader in infrastructure across equity, debt and solutions—providing a diverse range of infrastructure sector expertise and exposure across developed and emerging markets.”

This deal boosts BlackRock’s private markets assets under management (AUM) by 40%, with GIP’s portfolio of more than 300 active investments now under BlackRock’s control.

House Judiciary Chairman Representative Jim Jordan (R-OH) has accused BlackRock of “potentially violating U.S. antitrust law by entering into agreements to ‘decarbonize’ its assets under management and reduce emissions to net zero—with potentially harmful effects on Americans’ freedom and economic well-being.”

Key Companies Now Under BlackRock’s Control

With this acquisition, BlackRock gains influence over key infrastructure assets, including:

Energy: BlackRock now controls ADNOC Gas Pipelines and Freeport LNG, which are vital to global energy supplies.

Transport: Key transportation hubs like Gatwick Airport and Sydney Airport are now under BlackRock’s purview, affecting global travel and trade.

Water and Waste Management: BlackRock takes ownership of companies like the SUEZ Group, which manage critical water supplies and waste management for millions of people worldwide.

This acquisition brings with it significant control over the essential infrastructure that nations and populations depend on for their daily lives.

Long-Term Investment Trends Driving the Acquisition: A Concerning Power Play

BlackRock’s acquisition of GIP was not just about expansion—it’s a calculated move to take advantage of structural shifts in global infrastructure.

While BlackRock frames these trends as opportunities, they also signal a deeper concentration of power over essential services.

According to BlackRock: “A number of long-term structural trends support an acceleration in infrastructure investment. These include increasing global demand for upgraded digital infrastructure like fiber broadband, cell towers and data centers; renewed investment in logistical hubs such as airports, railroads and shipping ports as supply chains are rewired; and a movement toward decarbonization and energy security in many parts of the world.”

These so-called trends in “modernization” and “decarbonization” are more than business opportunities—they reflect BlackRock’s strategy to exert influence over critical sectors that countries depend on.

As BlackRock moves to capture these markets, it’s positioning itself to control key infrastructure that governments and populations have no choice but to rely on.

With governments facing large deficits, BlackRock will leverage public-private partnerships to further tighten its grip on essential infrastructure projects, ensuring it profits while nations depend on its funding.

But this shift isn’t just about infrastructure—it’s about BlackRock’s growing power over global resources.

The real concern is how this control will be wielded, and who stands to benefit most: the public, or the powers behind BlackRock and the WEF.

BlackRock’s Power to Direct Company Policies

Beyond just financial control, BlackRock’s acquisition allows it to shape the policies of the companies it now owns.

Asset managers like BlackRock can influence corporate strategies through boardroom votes and the allocation of financial resources.

Larry Fink, BlackRock’s CEO, openly acknowledged this control in a 2017 interview with the New York Times, where he stated, “You have to force behaviors, and at BlackRock, we are forcing behaviors.”

This admission reflects BlackRock’s active role in directing the companies it owns, using its financial power to shape corporate behavior.

World Economic Forum Connections and Agenda

The firm is also a key partner of the World Economic Forum (WEF), an organization known for advancing a global agenda that includes controversial initiatives like climate change action, Diversity, Equity, and Inclusion (DEI) efforts, and population management.

The WEF’s official partners, including BlackRock, are described as the “driving force” behind the Forum’s programs, which are aligned with the broader concept of the Great Reset—an effort to reshape global economies and governments according to the desires of an unelected global elite.

As BlackRock continues to shape corporate and infrastructure policies, these WEF-aligned programs are likely to influence its decisions in areas like energy production, transportation management, and public resource distribution.

A Concentration of Power With Global Impact

BlackRock’s $170 billion acquisition of GIP isn’t just a financial transaction—it represents a monumental shift in global power.

With control over infrastructure assets that fuel economies, transport goods, and provide water to populations, BlackRock now has the ability to direct these industries according to its policies and broader globalist agenda.

As stated by BlackRock in its press release, “Infrastructure represents a generational investment opportunity,” and with this acquisition, BlackRock is positioned to capitalize on that opportunity.

The question is not if but how this concentration of power will affect global markets and geopolitical systems, and whether BlackRock’s influence will ultimately serve America’s best interest or the interests of a select few.

Follow Jon Fleetwood: Instagram @realjonfleetwood / Twitter @JonMFleetwood / Facebook @realjonfleetwood

The WEF 'Axis of Evil': How The World Economic Forum Controls Everything You Do

The World Economic Forum (WEF) is behind the global climate change narrative, promoting China as the next world superpower, and worldwide Diversity, Equity, and Inclusion (DEI) efforts.

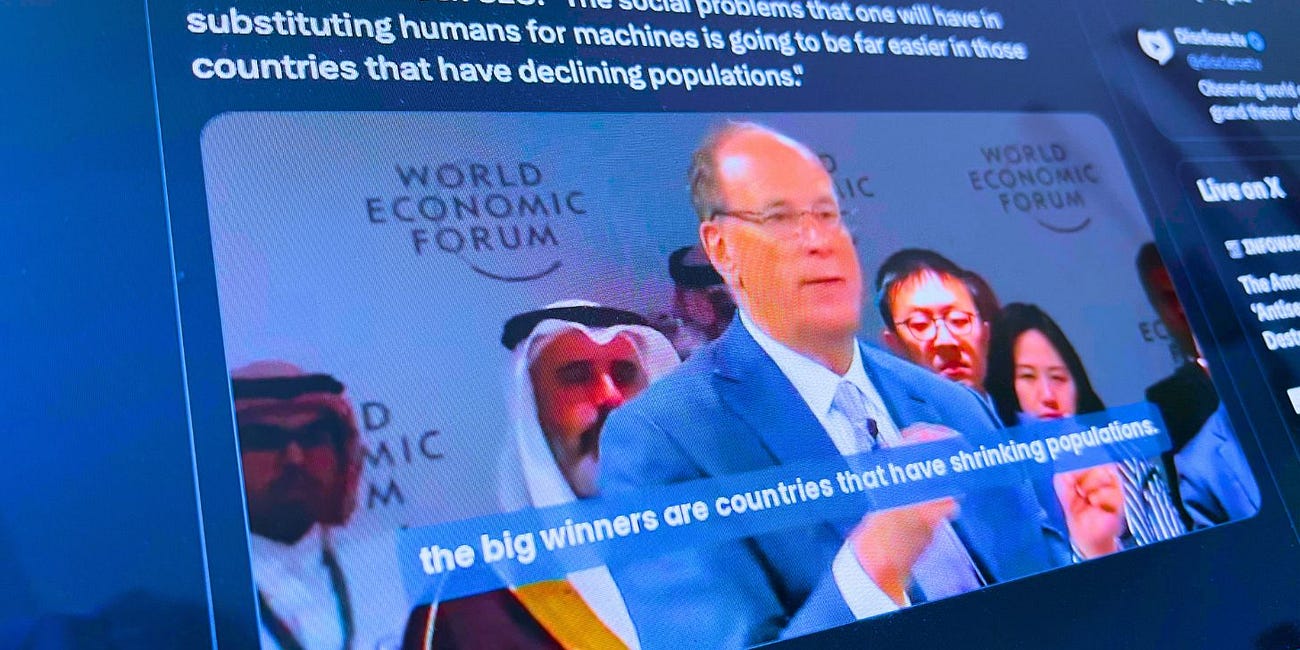

Depopulation Agenda Endorsed by WEF-Allied BlackRock CEO Larry Fink: 'Shrinking Populations' Better for 'Robotics and AI' Takeover (Video)

BlackRock Inc. CEO Larry Fink praised depopulation, an idea associated with reducing the number of people in a country or region, in remarks made during the World Economic Forum’s (WEF) recently held ‘Special Meeting on Global Collaboration, Growth and Energy Development’ in Saudi Arabia.

Simply put, it’s the holding company for the New World Order.

People continually say that truth will win the day and the miscreants will be punished. Not so much, at least in my lifetime.