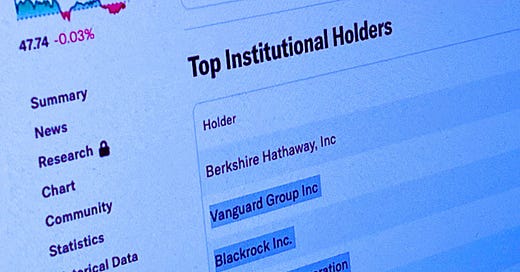

Texas AG Paxton, 10 Other States Sue BlackRock, State Street, Vanguard for 'Illegally Conspiring to Manipulate Energy Markets, Driving Up Costs for Consumers'

“Texas will not tolerate the illegal weaponization of the financial industry in service," says AG Ken Paxton.

Attorney General Ken Paxton has sued BlackRock, State Street Corporation, and Vanguard Group for “conspiring to artificially constrict the market for coal through anticompetitive trade practices.”

Follow Jon Fleetwood: Instagram @realjonfleetwood / Twitter @JonMFleetwood / Facebook @realjonfleetwood

A coalition of 10 other States joined Texas on the lawsuit against three of the largest institutional investors in the world: Alabama, Arkansas, Indiana, Iowa, Kansas, Missouri, Montana, Nebraska, West Virginia, and Wyoming.

“Over several years, the three asset managers acquired substantial stockholdings in every significant publicly held coal producer in the United States, thereby gaining the power to control the policies of the coal companies,” a press release from Paxton’s office reads.

“Using their combined influence over the coal market, the investment cartel collectively announced in 2021 their commitment to weaponize their shares to pressure the coal companies to accommodate ‘green energy’ goals. To achieve this, the investment companies pushed to reduce coal output by more than half by 2030.”

Blackrock, Vanguard, and State Street used the ‘Climate Action 100’ and the ‘Net Zero Asset Managers Initiative’ to “signal their mutual intent to reduce the output of thermal coal, which predictably increased the cost of electricity for Americans across the United States.”

The release claims the firms “also deceived thousands of investors who elected to invest in non-ESG funds to maximize their profits. Yet these funds pursued ESG strategies notwithstanding the defendants’ representations to the contrary.”

The investment companies artificially restricted supply to inflate prices, violating federal and Texas antitrust and deceptive trade practices laws by engaging in anticompetitive schemes.

“Deliberately and artificially constricting supply increased prices and enabled the investment companies to produce extraordinary revenue gains,” the press release reads.

“This conspiracy violated multiple federal laws that prevent a major shareholder, or a group of shareholders, from using their shares to lessen competition or engaging in other anticompetitive schemes. Further, the companies broke Texas antitrust and deceptive trade practices laws.”

Paxton commented: “Texas will not tolerate the illegal weaponization of the financial industry in service of a destructive, politicized ‘environmental’ agenda. BlackRock, Vanguard, and State Street formed a cartel to rig the coal market, artificially reduce the energy supply, and raise prices. Their conspiracy has harmed American energy production and hurt consumers. This is a stunning violation of State and federal law.”

The Buzbee Law Firm and Cooper & Kirk are to serve as outside counsel, per the announcement.

You can read the filing here.

Follow Jon Fleetwood: Instagram @realjonfleetwood / Twitter @JonMFleetwood / Facebook @realjonfleetwood

BlackRock’s Assets Reach $11.5 Trillion—Now Nearly 11% of Global GDP, Raising Concerns Over Expansive Influence

BlackRock Inc., the world’s largest asset manager, has seen its assets under management (AUM) swell to a staggering $11.5 trillion, a sum that now represents almost 11% of the global GDP.

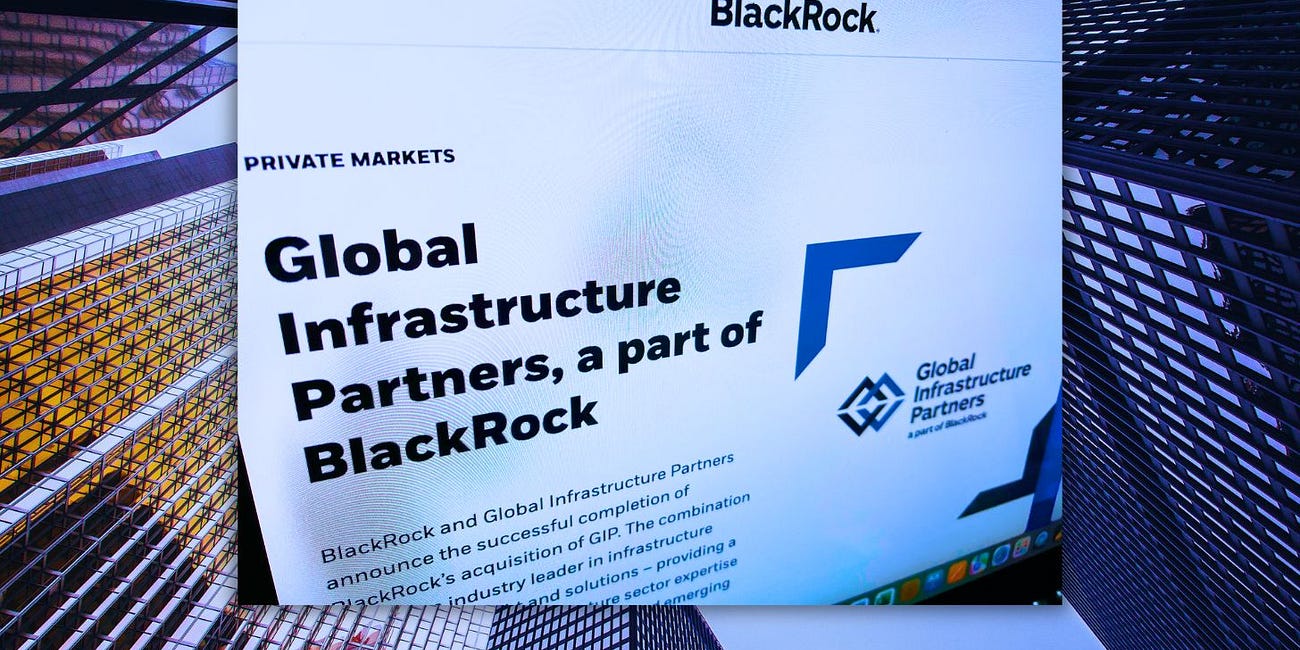

BlackRock's $170 Billion Infrastructure Takeover: How the World's Largest Asset Manager Now Controls Critical Global Resources

BlackRock Inc., the world’s largest asset manager, has completed its $170 billion acquisition of Global Infrastructure Partners (GIP), giving it control over new essential infrastructure in more than 100 countries.

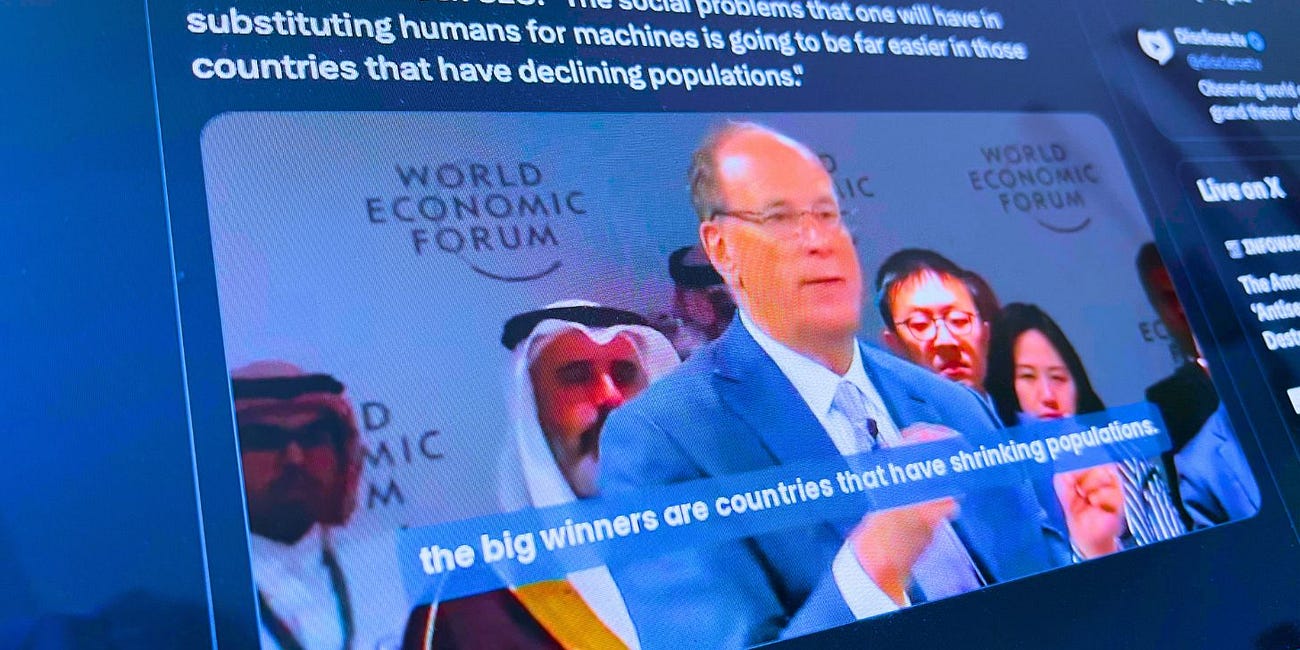

Depopulation Agenda Endorsed by WEF-Allied BlackRock CEO Larry Fink: 'Shrinking Populations' Better for 'Robotics and AI' Takeover (Video)

BlackRock Inc. CEO Larry Fink praised depopulation, an idea associated with reducing the number of people in a country or region, in remarks made during the World Economic Forum’s (WEF) recently held ‘Special Meeting on Global Collaboration, Growth and Energy Development’ in Saudi Arabia.

The WEF 'Axis of Evil': How The World Economic Forum Controls Everything You Do

The World Economic Forum (WEF) is behind the global climate change narrative, promoting China as the next world superpower, and worldwide Diversity, Equity, and Inclusion (DEI) efforts.

I’d like to see this cartel taken down, no settlement that keeps the status quo with a token cost-of-doing-business fine that would be inconsequential to these cartel members. Not holding my breath, but one can dream and hope.

Surprising? Time to end their reign.