BlackRock’s Assets Reach $11.5 Trillion—Now Nearly 11% of Global GDP, Raising Concerns Over Expansive Influence

The "greatest anticompetitive threat of our time"?

BlackRock Inc., the world’s largest asset manager, has seen its assets under management (AUM) swell to a staggering $11.5 trillion, a sum that now represents almost 11% of the global GDP.

Follow Jon Fleetwood: Instagram @realjonfleetwood / Twitter @JonMFleetwood / Facebook @realjonfleetwood

“BlackRock’s assets under management topped $11tn for the first time — sending its shares to a new peak — as the world’s largest money manager benefited from a rally in markets and attracted record new cash from investors,” Financial Times reported last week.

“The inflows helped push revenues up 15 per cent to $5.2bn, surpassing analysts’ expectations. Improved margins lifted the group’s net income to $1.63bn.”

BlackRock’s shares rose 3.6% on Friday, reaching a record high of $990.26 and surpassing their previous peak from November 2021.

According to the World Bank Group (WBG), the global GDP stands at $105.44 trillion, making BlackRock’s $11.5 trillion in assets under management equivalent to 10.91% of the world’s total economic output.

Gross Domestic Product (GDP) is the total monetary value of all goods and services produced and sold within a country or region over a specific period, usually one year.

Leaving out the U.S. and China, BlackRock’s AUM is greater than the GDP of every other country in the world.

The money manager owns controlling shares of the biggest international corporations across every major industry.

The milestone not only underscores BlackRock’s unprecedented growth but also brings into focus the vast influence it holds over global markets and corporate policies.

With shares across nearly every major sector, BlackRock is in a position to steer the policies and political directions of numerous companies.

CEO Larry Fink has openly acknowledged this influence, revealing in a 2017 interview that BlackRock is actively “forcing behaviors” on the companies it owns.

“Behaviors are gonna have to change, and this is one thing we’re asking companies. You have to force behaviors, and at BlackRock, we are forcing behaviors,” Fink stated.

BlackRock’s sway extends beyond mere financial metrics; as an official partner of the World Economic Forum (WEF), it is aligned with a global agenda advocating for initiatives involving “climate change,” so-called Diversity, Equity, and Inclusion (DEI), and the WEF’s controversial “Great Reset.”

Fink predicts his firm’s growth will continue: “We expect momentum to further build to year’s end and into 2025,” he told analysts, per Financial Times. “Investors will have to re-risk to meet their long-term return needs.”

“Our strategy is ambitious and our strategy is working,” he added. “I have never felt more optimistic. Capital markets are becoming a bigger and bigger part of the global economy.”

Through its alliances with influential bodies like the WEF, BlackRock is shaping global narratives and influencing the international corporate landscape on a monumental scale.

This massive accumulation of capital, equal to nearly one-tenth of global GDP, invites serious reflection on the reach and consequences of concentrated financial power in an increasingly interconnected world.

The Risks of Concentration: Bogle Warns Against Asset Managers’ Growing Power Over U.S. Corporations

In his 2018 Wall Street Journal article, John Bogle, the founder of asset manager Vanguard and pioneer of the index fund, issued a stark warning about the potential dangers posed by the dominance of index funds and large asset managers.

As index funds increasingly capture a larger share of the market, Bogle argues that this growing concentration of corporate ownership by a few firms could undermine the interests of American investors and society at large.

Bogle points out that three major players—Vanguard, BlackRock, and State Street—at the time controled 81% of all index fund assets, raising concerns that “a handful of giant institutional investors will one day hold voting control of virtually every large U.S. corporation.”

He argues that this level of concentration is not in the national interest and could lead to “practical power over the majority of U.S. public companies” being held by a small number of individuals.

Bogle, who died just weeks after writing his WSJ piece, outlines several alarming consequences of this trend:

Reduced Competition: High barriers to entry, such as scale and low expense ratios, make it challenging for new entrants to compete, which further consolidates control among the dominant players.

Potential for Policy Manipulation: With significant stakes in various industries, these asset managers could influence corporate policies and strategies, which might not always align with shareholder interests.

Corporate Governance Risks: Concentrated ownership enables these firms to exercise considerable influence over corporate decisions through boardroom voting power, potentially prioritizing the firm’s own agenda over shareholder or societal interests.

To counter these risks, Bogle proposed several potential solutions, including requiring asset managers to fully disclose their voting policies, creating independent supervisory boards for index funds, and enforcing fiduciary duties that prioritize the interests of fund shareholders.

Bogle emphasized the need for public policy to mitigate the risks of asset managers’ power to ensure it aligns with the broader interests of investors and the public.

In Bogle’s words, “I do not believe that such concentration would serve the national interest.”

Follow Jon Fleetwood: Instagram @realjonfleetwood / Twitter @JonMFleetwood / Facebook @realjonfleetwood

Asset Managers as Modern ‘Money Trusts’ and ‘Greatest Anticompetitive Threat of Our Time’

As the world’s largest asset managers, firms like BlackRock, Vanguard, and State Street have grown into powerful entities, controlling not only vast financial resources but also wielding substantial influence over corporate America.

Their massive portfolios, combined with voting power, allow them to shape the policies and governance of many corporations.

For instance, BlackRock alone holds a significant portion of shares in nearly all S&P 500 companies, exerting influence over decisions that affect entire industries.

A 2020 report from the American Economic Liberties Project warns that this trend creates a “new money trust” reminiscent of early 20th-century financial giants.

These asset managers are now deeply entwined with governmental and financial institutions, sometimes acting in ways that conflict with broader societal interests.

Justice Louis Brandeis criticized this kind of interlocking corporate power, highlighting how it leads to “inefficiency and disloyalty” at the expense of the public.

Further concerns relate to “horizontal shareholding,” where asset managers with stakes in competing companies within the same industry may discourage competition, effectively promoting anti-competitive practices to maximize returns across their portfolios.

This approach could lead to higher costs for consumers, stagnating wages, and reduced innovation, presenting what some legal scholars deem the “greatest anticompetitive threat of our time.”

The intertwining of financial and political influence by such asset managers raises questions about the future of corporate governance and market competition.

These firms have a growing ability to prioritize their agendas, often focusing on goals like environmental and social governance, which may not always align with shareholder or public interests.

Follow Jon Fleetwood: Instagram @realjonfleetwood / Twitter @JonMFleetwood / Facebook @realjonfleetwood

BlackRock's $170 Billion Infrastructure Takeover: How the World's Largest Asset Manager Now Controls Critical Global Resources

BlackRock Inc., the world’s largest asset manager, has completed its $170 billion acquisition of Global Infrastructure Partners (GIP), giving it control over new essential infrastructure in more than 100 countries.

The WEF 'Axis of Evil': How The World Economic Forum Controls Everything You Do

The World Economic Forum (WEF) is behind the global climate change narrative, promoting China as the next world superpower, and worldwide Diversity, Equity, and Inclusion (DEI) efforts.

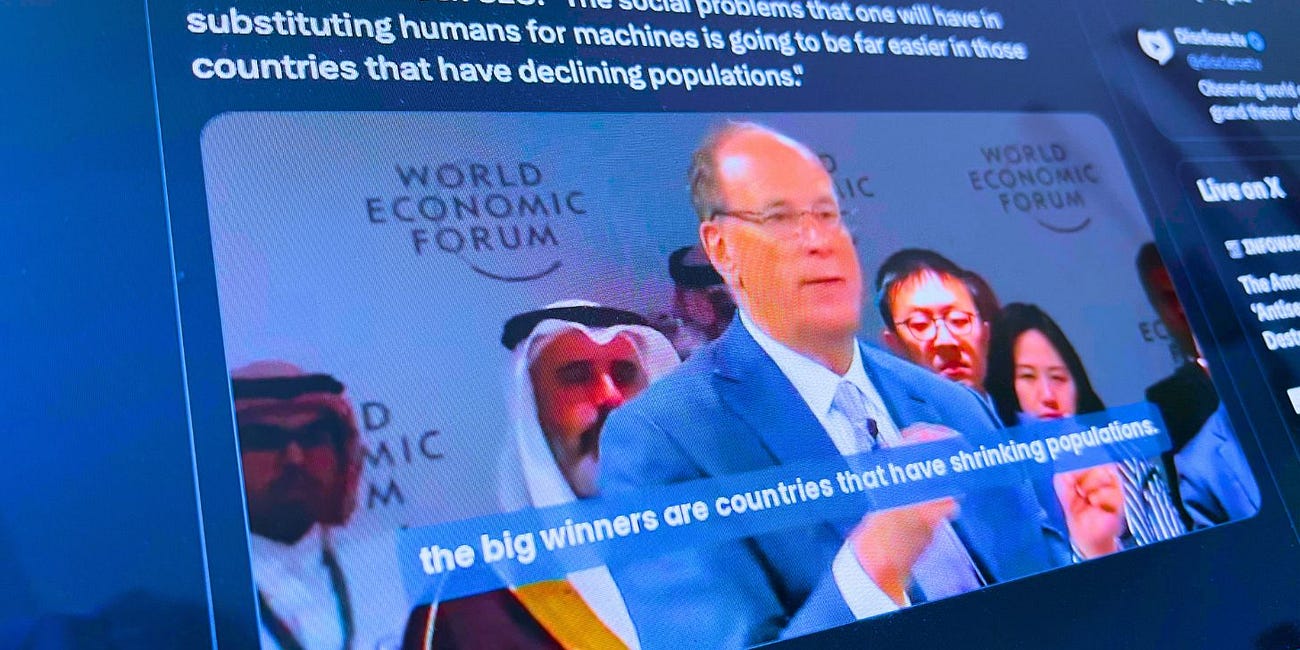

Depopulation Agenda Endorsed by WEF-Allied BlackRock CEO Larry Fink: 'Shrinking Populations' Better for 'Robotics and AI' Takeover (Video)

BlackRock Inc. CEO Larry Fink praised depopulation, an idea associated with reducing the number of people in a country or region, in remarks made during the World Economic Forum’s (WEF) recently held ‘Special Meeting on Global Collaboration, Growth and Energy Development’ in Saudi Arabia.

Have these companies reached the point of monopolizing, and if so, are they not supposed to be split up like Bell telephone was many years ago??

I believe they were the largest shareholders of all the mandating international corporations, also the same for the pharmaceutical companies. Obviously just anoth climate change co incidence