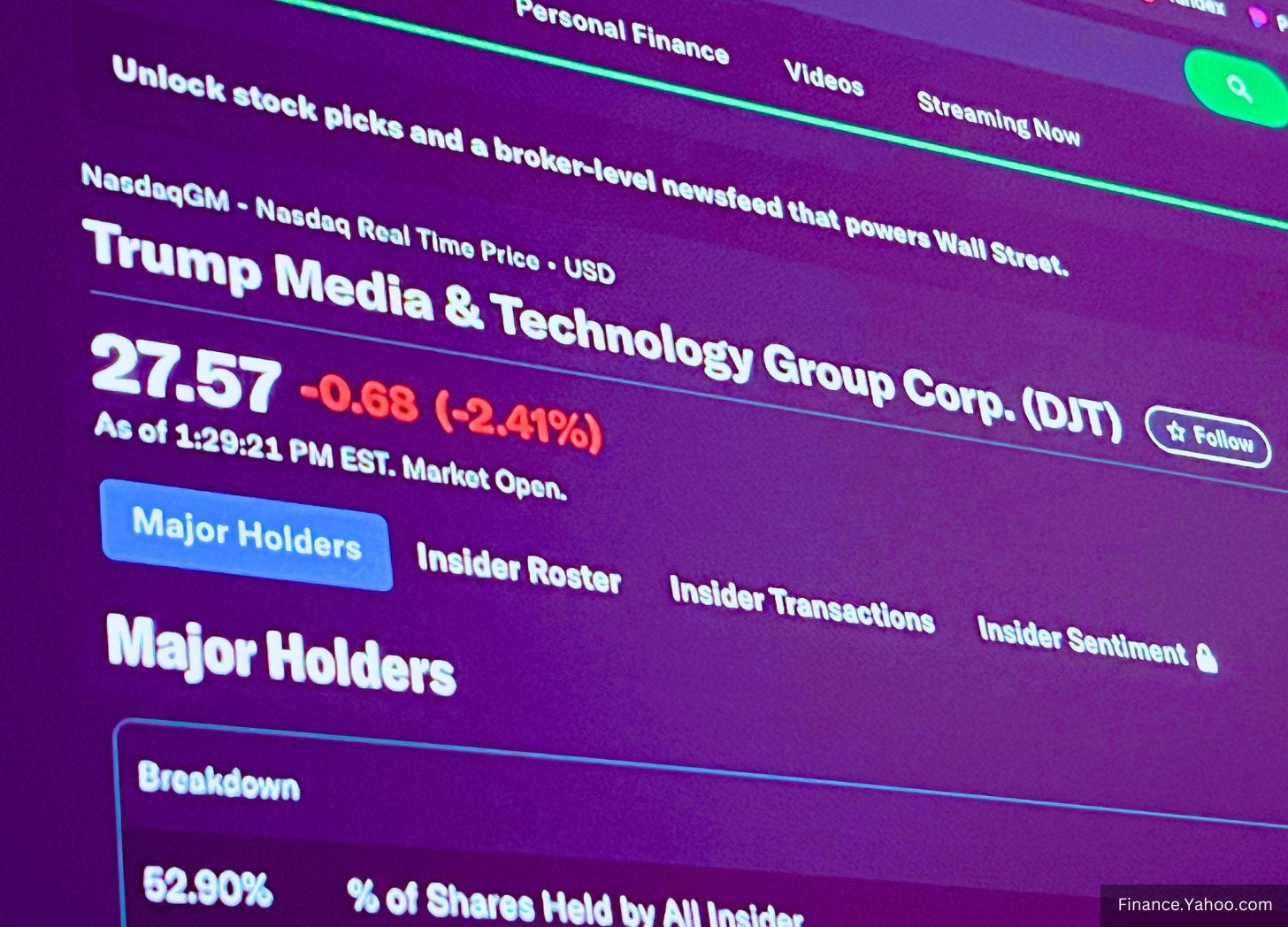

BlackRock, Vanguard Hold 13 Million Shares in Trump Media Corp Valued at $350 Million

WEF-partnered asset managers are top shareholders of Trump Media & Technology Group Corp.

BlackRock and Vanguard—two of the world’s largest asset managers, both affiliated with the World Economic Forum (WEF)—are among the top institutional shareholders of Trump Media & Technology Group Corp. (DJT), the publicly traded company behind Truth Social, according to newly released financial filings.

Follow Jon Fleetwood: Instagram @realjonfleetwood / Twitter @JonMFleetwood / Facebook @realjonfleetwood

The news follows reports from last year indicating BlackRock had participated in a landmark $6 billion Series C financing round for Elon Musk’s AI venture, xAI.

Musk and Trump share a tight-knit bond, forged through Musk’s $250 million contribution to Trump’s 2024 campaign, frequent joint appearances, and Trump’s vocal admiration, culminating in Musk’s appointment to lead the Department of Government Efficiency (DOGE) in Trump’s administration.

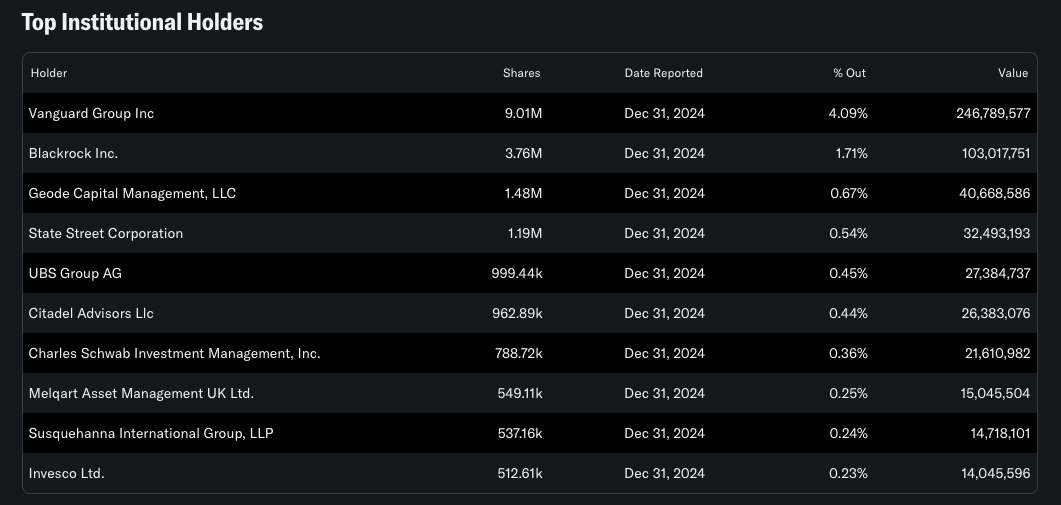

As of December 31, 2024, Vanguard Group Inc. held 9.01 million shares in DJT, accounting for 4.09% of DJT’s outstanding shares, with a market value of $246.8 million, according to Yahoo! Finance.

BlackRock Inc. followed with 3.76 million shares, representing 1.71% of the company’s stock, valued at $103 million.

In total, the two investment giants control approximately 13 million shares worth nearly $350 million.

These holdings place BlackRock and Vanguard at the top of DJT’s institutional investor list, alongside other major firms such as Geode Capital Management LLC (1.48 million shares, valued at $40.6 million) and State Street Corporation (1.19 million shares, valued at $32.4 million).

According to the WEF, a future is coming in which global citizens will “own nothing” and “be happy” about it, and the United States will no longer be the world’s leading superpower.

BlackRock’s allegiance to the WEF’s agenda is significant because the asset manager owns controlling shares of thousands of companies across multiple industries, including many of those on the Fortune 500 and Fortune 100 lists.

The Forum’s programs are currently advancing the worldwide climate change narrative; Diversity, Equity, and Inclusion (DEI) efforts; and population management.

Given BlackRock’s extensive history of influencing U.S. government policies through strategic investments and political engagements, its significant stake in Trump Media & Technology Group raises questions about the potential impact on both the company’s direction and President Trump’s policy decisions.

WEF Ties to BlackRock & Vanguard

Both BlackRock and Vanguard maintain longstanding ties to the World Economic Forum (WEF), an organization that has championed digital censorship and ESG (Environmental, Social, and Governance) policies—positions that directly conflict with Truth Social’s mission of providing a platform for free speech.

BlackRock CEO Larry Fink, a WEF trustee, has openly advocated for corporate governance models that leverage “forcing behaviors” to align with globalist agendas.

Vanguard, while more discreet, is similarly entrenched in WEF-driven financial policies.

In 2022, Vanguard became a founding member of the Global Parity Alliance, a group “dedicated to advancing diversity, equity, and inclusion (DEI) in the workplace,” according to a press release from the time.

Vanguard was the first asset management company to participate in the alliance, which was launched in March of that year by the World Economic Forum.

Institutional Influence Over Trump’s Media Venture

The revelation that BlackRock and Vanguard are major stakeholders in Trump’s media company raises questions about the influence these asset managers could exert over the platform.

Historically, these firms have used their ownership stakes in major corporations to push ESG compliance and other globalist political initiatives.

Whether their involvement in DJT will lead to pressure on Truth Social remains to be seen.

Will BlackRock & Vanguard Leverage Their Stakes?

The presence of WEF-aligned asset managers as top shareholders of DJT could have broader implications.

If history is any indication, BlackRock and Vanguard’s involvement in companies often precedes shifts in corporate policy—whether through direct boardroom influence or shareholder resolutions.

For now, Trump Media & Technology Group remains in the hands of a largely independent investor base.

But the question lingers: will BlackRock and Vanguard attempt to influence Truth Social’s direction or President Trump’s policy priorities, or are their holdings simply passive investments in a lucrative, high-profile stock?

Time will tell.

Follow Jon Fleetwood: Instagram @realjonfleetwood / Twitter @JonMFleetwood / Facebook @realjonfleetwood

Texas AG Paxton, 10 Other States Sue BlackRock, State Street, Vanguard for 'Illegally Conspiring to Manipulate Energy Markets, Driving Up Costs for Consumers'

Attorney General Ken Paxton has sued BlackRock, State Street Corporation, and Vanguard Group for “conspiring to artificially constrict the market for coal through anticompetitive trade practices.”

The WEF 'Axis of Evil': How The World Economic Forum Controls Everything You Do

The World Economic Forum (WEF) is behind the global climate change narrative, promoting China as the next world superpower, and worldwide Diversity, Equity, and Inclusion (DEI) efforts.

BlackRock’s Assets Reach $11.5 Trillion—Now Nearly 11% of Global GDP, Raising Concerns Over Expansive Influence

BlackRock Inc., the world’s largest asset manager, has seen its assets under management (AUM) swell to a staggering $11.5 trillion, a sum that now represents almost 11% of the global GDP.

BlackRock Joins $6 Billion Funding for Musk's xAI, Sparking Concern Over Globalist Influence in AI's Future

BlackRock Inc. has participated in a landmark $6 billion Series C financing round for Elon Musk’s AI venture, xAI, cementing the asset manager’s growing influence and strategic leverage over the company’s future direction.

BlackRock, Vanguard, & State Street own each other (meaning they are essentially one entity). Via your 401K they control almost every company on earth (meaning all of that control is in the hands of one company). They essentially act as a one-world-government as a result (ESG, DEI, CEI, HRC spring from their funding via the WEF). Everyone on the planet needs to watch this:

Orwellian BlackRock CEO Larry Fink: We Are Forcing Behaviors To Change, How? By OWNING Everything!: https://old.bitchute.com/video/ei6QD8ZPl6DU [45:35mins]

The reason the elite parasites are in pursuit of a one-world-government is so that all power, wealth, freedom, & assets will be concentrated into the hands of a few, let's say the .0001%. A nightmare world will ensue. BlackRock must be shattered and splintered into a million pieces, or the cancer they represent will fully metastasize and we will wake up to that reality.

Meet BlackRock's ALADDIN: The Autonomous AI in Control of Nearly Every Market On Earth: https://old.bitchute.com/video/u7yIHKgIShfZ [7:35mins]

George Soros's HRC: Controlling Schools, Companies, & Municipalities With Woke Investment Funds: https://old.bitchute.com/video/7bwmUp5PHzxd [1:30mins]

Companies Are Following the WEF's Trans Script bc they Will Lose Their Funding Otherwise ESG DEI CEI: https://old.bitchute.com/video/LVsG0hV38oHj [2:51mins]

Best of luck everyone...

Great reporting. Larry Fink is a globalist sociopath. I would bet the Black Rock influence might affect Trump's Greater Israel decisions. I am sure Fink would love to be on the ground floor of Trump's Gaza resort by the sea development initiative. He gets a bigger Israel footprint to make his friends happy and a cool investment along with it. I will await Steve Bannon's perspective on this.