Trump Considers 'No Income Taxes at All': New York Times (Video)

"There is a way, if what I’m planning comes out," said Trump of replacing federal revenue from income taxes with money received from tariffs.

Former President Donald J. Trump has raised the possibility of eliminating income taxes entirely, The New York Times reported today.

Follow Jon Fleetwood: Instagram @realjonfleetwood / Twitter @JonMFleetwood / Facebook @realjonfleetwood

“During a Fox News segment on Monday, Mr. Trump took questions at a barbershop in the Bronx. When asked if the United States could potentially end all federal taxation, Mr. Trump said the country could return to the economic policies in the late 19th century, when there was no federal income tax,” the report reads.

“It had all tariffs—it didn’t have an income tax,” Trump said. “Now we have income taxes, and we have people that are dying. They’re paying tax, and they don’t have the money to pay the tax.”

A tariff is a tax imposed by a government on imported goods, intended to raise revenue and protect domestic industries by making foreign products more expensive.

Trump also floated the idea of replacing federal revenue from income taxes with money received from tariffs back in June.

“There is a way, if what I’m planning comes out,” Trump said, arguing that companies overseas bear the cost of tariffs on the products they ship to the United States.

The former president has also promised that if elected president in November, his administration will eliminate taxes on tips for people working jobs in hotels, restaurants, or other industries.

Video Source: Twitter (X)/@DavidJHarrisJr

Ron Paul: The Original Advocate for Eliminating Income Tax

Former Texas Representative Ron Paul (R) has consistently opposed the federal income tax system, believing it to be unconstitutional.

He argues that the way taxes are collected assumes guilt until proven innocent, which conflicts with constitutional principles.

Paul’s ultimate goal would be reducing the income tax rate to zero, advocating for everyone to be taxed at the same, minimal rate.

Rather than proposing a replacement system, Paul calls for the complete abolition of both the income tax and the IRS, reflecting his broader philosophy that government should play a minimal role in individuals’ lives.

His libertarian economic views underpin this stance, as he believes individuals should own all of what they earn, without the government claiming a portion of it.

Paul asserts that the current system falsely presupposes that the government owns 100% of a person’s income, only allowing people to keep part of it if they comply with regulations.

During his time in Congress, Paul introduced various tax-reduction proposals, including the ‘Tax Free Tips Act,’ which sought to exempt tips from federal income and payroll taxes.

He also pushed for legislation that would completely eliminate the IRS and the income tax, though he opposed other tax reform measures like the “Fair Tax.”

Ultimately, his position on income tax is aligned with his broader vision of reducing government control and expanding individual economic freedom.

In 2012, then-presidential candidate Paul introduced the Tax Free Tips Act, which would have exempted tips from federal income and payroll taxes, “meaning no more taxes on tips,” he explained in an op-ed he wrote at the time.

“That’s because I understand ending taxes on tips will give these workers a pay raise, letting them keep more money to put toward things like a house or car payment, their retirement, or their own and/or their children’s education.”

The former Texas congressman wanted to “end this injustice on service-industry workers all across our nation by abolishing all taxes on tips once and for all.”

“Helping Americans improve themselves by reducing their taxes will make our country—and our economy—stronger. I think that’s something we all agree must happen if we are to fix our economy and get America back on track.”

Paul once appeared on Fox Business to discuss the nature of income tax.

“The real unconstitutionality of the tax code and the income tax is the way they collect it,” he said. “It assumes you’re guilty until proven innocent and that turns the constitution on its head.”

“We’re halfway there because really if you’re living in a free society, the founders didn’t intend it, if you had the proper size government, there would be no income (tax),” Paul added.

“In a free society, you should own all the fruits of your labor and the whole country would be better off.”

Follow Jon Fleetwood: Instagram @realjonfleetwood / Twitter @JonMFleetwood / Facebook @realjonfleetwood

U.S. Military Authorized to Use Lethal Force on American Soil: DoD Directive 5240.01

In a shocking development, the Depa…

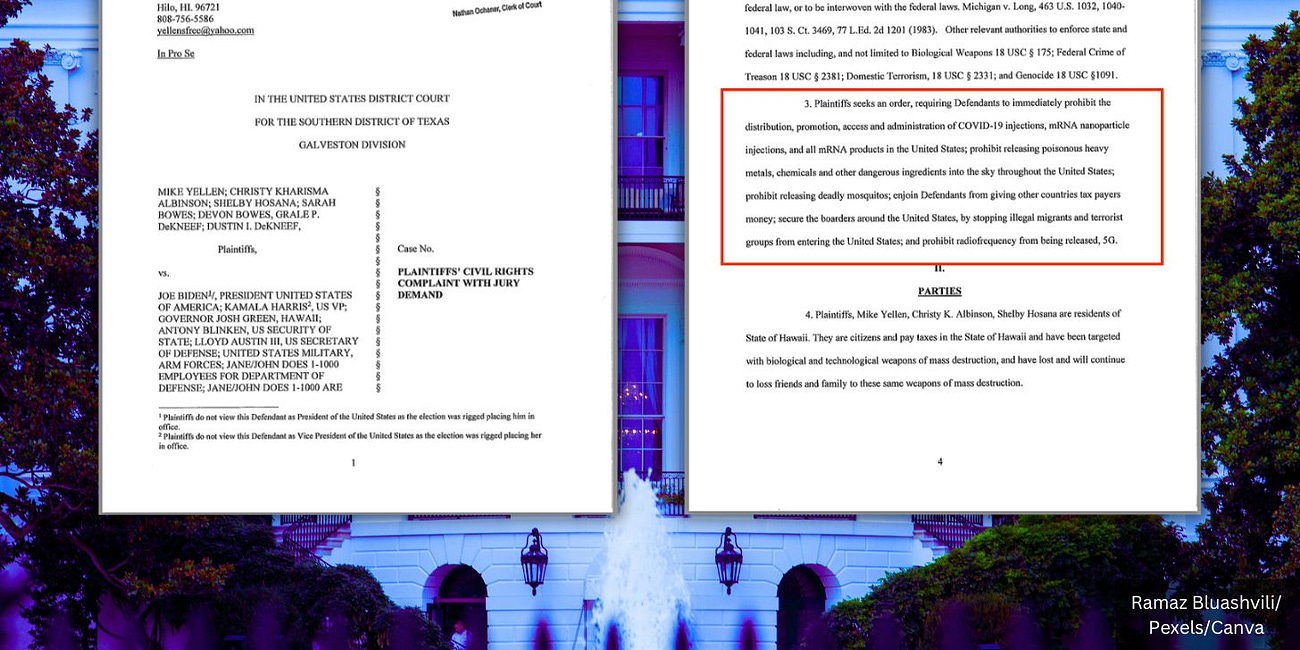

Biden Admin Accused of ‘Murder,’ ‘Treason,’ ‘Genocide,’ and Use of ‘Weapons of Mass Destruction’ with COVID-19 Shots, 5G, Chemtrails, Mosquitos: Texas Lawsuit

A monumental lawsuit filed on October 15, 2024, in the Southern District of Texas accuses Joe Biden, Dr. Rochelle Walensky, Alejandro Mayorkas, and other top officials of “murder,” “treason,” “genocide,” and facilitating the use of weapons of mass destruction.

'We Will Make Americans Healthy Again': RFK Jr. Joins Trump in Historic Alliance to Combat Government Corruption, Chronic Disease (Video)

In a stunning announcement that could reshape the 2024 presidential race and fix the failing American health system, Robert F. Kennedy Jr. suspended his independent campaign for the White House and endorsed former President Donald Trump.

Trump Vows to Investigate Big Pharma for Rise in Autism, Infertility, Obesity, Allergies, Child Illness (Video)

In a recent address, former President Donald Trump expressed grave concerns over the increasing prevalence of chronic illnesses among children.

RFK Jr. Vows to End Chemtrails: 'We Are Going to Stop This Crime'

Robert F. Kennedy Jr. (RFK Jr.) on Monday vowed to stop airplanes from carrying out the “crime” of spraying chemicals, often referred to as “chemtrails,” into the sky behind them as they fly for geoengineering purposes.

Hell yes.

Tariffs and natural resources export fees could do it. And throwing out the fed senior executive service, cutting the Pentagon by at least 30%, getting rid of DHHS, DOE, get rid of the F.R. bloodsuckers...

Excellent idea! Good info. Thanks